- All

- Business Management

- Business Tips

- Consultants

- Disaster

- Economy

- Finances

- Growing a Business

- Human Resources

- Marketing

- Starting a Business

- All

- Business Management

- Business Tips

- Consultants

- Disaster

- Economy

- Finances

- Growing a Business

- Human Resources

- Marketing

- Starting a Business

Attorney Gene’s Top Tips for Hiring Employees

One of the hallmarks of a truly successful business is the need to hire additional employees. If your business is ready to hire employees, here’s how to go about it. Tip #1. Use a modern, legally-compliant job application form. Colorado has a new “ban the box” statute that prohibits use of job application forms asking whether the applicant has ever been convicted of a felony. “What???,” you say! True. And that is for some reasons …

How to Monetize Your Knowledge With a Consulting Business (Pt 2)

By Steven Imke | SBDC Consultant “The goal of the pitch is not getting a commitment to hire you, but to make the engagement more personal…” Steven Imke | SBDC Consultant Tweet Previously, we discussed how to properly target, prospect, and qualify consulting engagement leads as a way to monetize your knowledge as a consulting business. In this post, we cover the pitch meeting and how to write a winning proposal. Pitch Meeting Once you have a qualified lead with …

How to Monetize Your Knowledge With a Consulting Business (Pt 1)

By Steven Imke | SBDC Consultant “Having a consulting business is all about being able to monetize your knowledge.” Steven Imke | SBDC Consultant Tweet Having a consulting business is all about being able to monetize your knowledge. Most consulting businesses have a very narrow, but deep knowledge of a particular subject such as cybersecurity, human resource management, the law, etc. While some consulting businesses have more than one employee, a large number are simply composed of one freelance …

Small Business and International Health Crisis: Business Preparedness vs. Freaking out

Do you remember how it felt after Waldo Canyon Fire, the Black Forest Fire, and the floods following our regional disasters? If you were a small business, you might still be feeling the after effects. Recovery takes a long time, especially in a community that relies on tourism. On Tuesday, Gov. Jared Polis declared a state of emergency in response to the spread of COVID-19. “People who work in food, childcare, health care, education and …

Attorney Gene’s Top Tips for Hiring Independent Contractors

The ability to avoid payroll taxes and other regulatory aspects of hiring employees causes many small businesses to turn instead to hiring independent contractors. However, do not make the mistake of thinking that independent contractors and employees are interchangeable based merely upon what you choose to call them. Don’t misclassify workers as “independent contractors” when, legally, they’re “employees.” Laws exist to protect workers from being taken advantage of by people who hire workers as “contractors” …

Attorney Gene’s Top Tips for Staffing Up

There comes a time when a small business owner may declare: “I need to hire someone to help me. I can’t do everything by myself.” Here are my top tips for businesses in need of staffing help. Farm it out. Many small business owners do their own payroll, accounts payable, accounts receivable, and tax returns. Bite the bullet and hire a professional so that you can spend your time making money and doing what you’re …

Do I Need Business Insurance?

By Heather McBroom | Founder of Precision Services “You work incredibly hard to build a company, why put all that work at risk?” Heather McBroom | Founder of Precision Services Tweet Even though most types of insurance for your business are not required by law, it is CRUCIAL for small businesses to carry proper insurance, regardless of what kind of business you own. The 3 main types of business insurance are General Liability, Professional Liability, and Product Liability. The …

How to See Immediate Results From Your Website

By Tim Fitzpatrick | SBDC Consultant + President of Rialto Marketing “Your website is the workhorse of your marketing plan. Virtually everything you do from a marketing standpoint will drive people back to your website.” Tim Fitzpatrick | SBDC Consultant + President of Rialto Marketing Tweet Your website is the workhorse of your marketing plan. Virtually everything you do from a marketing standpoint will drive people back to your website. Yet, most businesses make many common mistakes with their websites. …

Tips for Securing a Business Loan

By Jackie Gonzalez | SBDC Consultant + Business Banker, ABC Bank “CASH FLOW not REVENUE is KING! In commercial lending the focus is on the cash available to service the debt (cash flow).” Jackie Gonzalez | SBDC Consultant + Business Banker, ABC Bank Tweet Commercial bank lending is based on risk. The higher the risk the business poses to the lender, the harder it will be to borrow. The following tips are designed to help you present your best case …

Are You Ready for Big Wage Changes in 2020?

By Reanna Werner, MBA, SPHR, SHRM-SCP | Co-Founder, HR Branches “On January 1, 2020, we are going to wake up to two significant wage changes that will impact most Colorado small businesses.” Reanna Werner, HR Branches Tweet On January 1, 2020, we are going to wake up to two significant wage changes that will impact most Colorado small businesses. Are you prepared for these changes? What’s Changing? Hourly Employees: Colorado Minimum Wage- Colorado minimum wage has been on …

The Value of Acquiring and Retaining a Business Consultant

By Ron O’Herron | Pikes Peak SBDC Lead Veterans Consultant “The reality and value of a GOOD business consultant is that they don’t get caught up in the “Forest for the Trees” mindset.” Ron O’Herron – Pikes Peak SBDC Consultant Tweet A business professor once stated to his class that the definition of a consultant was “a person who rides down from the top of the hill after the battle is over and shoots all the …

5 Seasoned, Local Business Owners Give Advice on What It Takes To Run a Business

Building a business is tough. As SBDC consultant Steve Imke says: “It’s not for everyone. There are easier ways to make money.” It can also be one of the most rewarding experiences of your life. The Pikes Peak SBDC is committed to helping businesses of all sizes in the Pikes Peak region grow. So we decided to tap the experts, asking them for advice on what it takes to run a business in this current …

Citation? Blacklink? Whaaa? 4 SEO Tips from COS Locals

Hello Small Businesses! As you know, marketing is an essential part to owning a small business in Colorado Springs. However, as we all know marketing has expanded past traditional mediums (billboards, radio, television, etc…) and encompasses a variety of newer, digital methods (Facebook Ads, Adwords, Snapchat, etc…). At the top of the digital marketing realm is search engine optimization, easily the most important… arguably the most confusing. We’ve assembled a team of the top SEO …

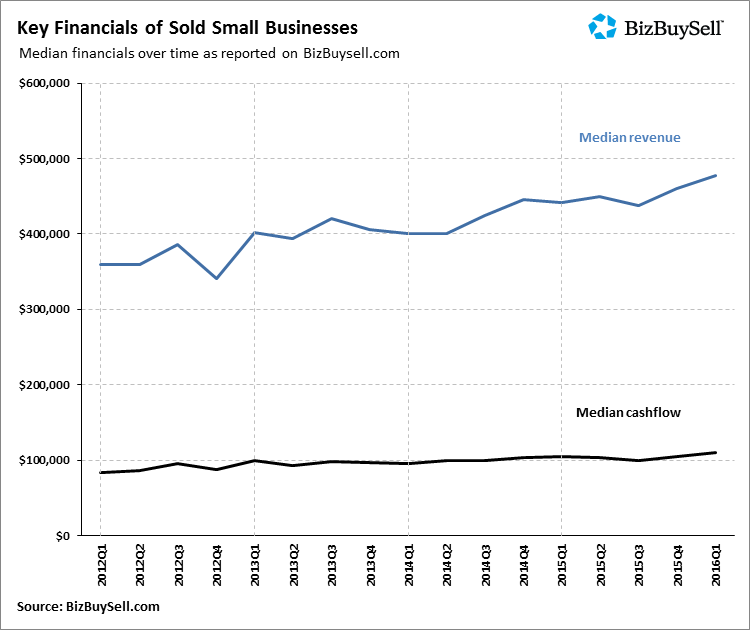

Sellers Cashing Out: Business for Sale Listings Reach 7 Year High

From BizBuySell.com BizBuySell’s Q1 2016 Report on small business transactions showed small businesses listed for sale reach their highest number since 2009. Furthermore, median revenue and median cash flow of business sold during this period reached their highest level since BizbuySell first started tracking data in 2007. Improved financials allowed sellers to ask for and receive hgiher sale prices, with median sale prices increasing 10 percent year-over-year. Learn more about what influenced …

3 Risk Levels to Becoming a Business Owner

By Steve Imke | Pikes Peak SBDC Consultant | Writer at www.stevebizblog.com “Starting a business from scratch is by far the riskiest way to become a business owner.” Steve Imke – Pikes Peak SBDC Consultant Tweet Most of the clients I see want to start their business from scratch, but there are 2 other options to becoming a business owner. The first option is to buy an existing business and the second is to buy a franchise. …

The Hidden Value of Crowdfunding

By Steve Imke, SBDC Consultant and Small Business Specialist Traditionally, entrepreneurs had 2 options to raise funds to start their business. They could either get a loan or give away ownership to investors. Because of the risk involved in the early stages of a small business, founders had to give up large blocks of equity to entice an early stage equity investor. On the other hand, having to make interest and principle payments for debt …

Turn Your Financials into a Powerful Management Tool

How many of you have seen the ”Dave” Staples commercial? It shows “Dave” serving in all the positions of his company, asking “Dave” when “Dave” needs help. As business owners we serve in so many capacities, it is difficult, if not impossible to do everything well. When we get pressured, we get stressed. Negative stress (yes, there is positive stress) can cause exhaustion and illness often follows. Most of us have experienced that sinking feeling …

Has your business been affected by the recent floods?

Across Colorado several businesses have been affected by the recent floods. The Colorado SBDC Network is here to help your business with the recent disasters including wildfires and floods. If you have questions, concerns, or need guidance please contact your local SBDC for assistance through the disaster loan applications, long term planning, insurance navigation, physical and economic loss estimations, business preparedness and more. The NEECCO SBDC and several others across the state are partnering with …